Travel Insurance

Get a Quantum Travel Insurance Quote – It’s Fast and Easy

– H Miller

Planning for your trip is always fun and we want you and your family to go discover the world and return home safely without ever having to call us.

However, Quantum Insurance, as your insurer, knows about all the unpredicted things that happen to people overseas every single day. Our Travel policy coverage is designed to cover such events, making it helpful, hassle-free, easy and of great worth for you.

For frequent travellers, we want each of your single trips to be a safe and enjoyable experience so you can enjoy the benefits of our Plan 3 cover under an Annual Multi-Trip Scheme.

We cover you up to a maximum of 180 days for single trip policies and the age limit for our travel cover is 75 years old.

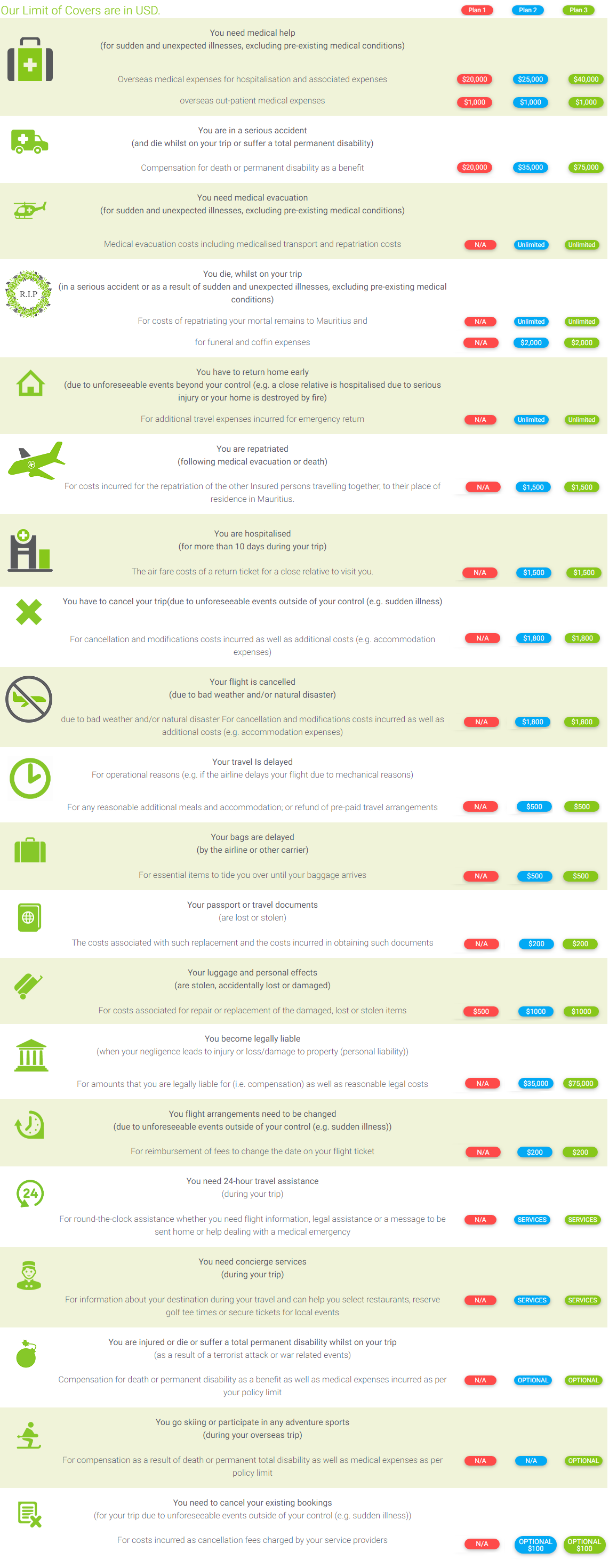

Compare Our Plans