Travel Insurance

Get a Quantum Travel Insurance Quote – It’s Fast and Easy

– H Miller

Planning for your trip is always fun and we want you and your family to go discover the world and return home safely without ever having to call us.

However, Quantum Insurance, as your insurer, knows about all the unpredicted things that happen to people overseas every single day. Our Travel policy coverage is designed to cover such events, making it helpful, hassle-free, easy and of great worth for you.

For frequent travellers, we want each of your single trips to be a safe and enjoyable experience so you can enjoy the benefits of our Plan 3 cover under an Annual Multi-Trip Scheme.

We cover you up to a maximum of 180 days for single trip policies and the age limit for our travel cover is 75 years old.

Travel Insurance Plan One – Value Cover

We wander for distraction but we travel for fulfilment

– H Belloc

This cover is designed in such a way that it matches your expectations in terms of basic level of benefits which may prove adequate if you are only seeking principally for personal protection and cover for your personal effects without considering any thrills assistance coverage during your trip.

Your Travel Insurance-Plan One covers:

- For hospitalisation expenses

- For out-patient medical expenses

- For permanent disability and death

- For your luggage

Travel Insurance Plan Two – Complete Cover

All journeys have secret destinations of which the traveller is unaware

– M Buber

This cover is designed in such a way that it matches your expectations in terms of level of benefits with an intermediate scope of coverage between our three proposed plans.

Your Travel Insurance-Plan Two covers:

- Unlimited:

- overseas emergency medical assistance

- overseas emergency return

- Travel documents and passport

- Travel delays (meals, accommodation, luggage and personal effects)

- Alternative transport expenses if your scheduled transport is cancelled, delayed, shortened or diverted

- Permanent disability and loss of income

- Booking cancellation fees and lost deposits (subject to terms, conditions and exclusions)

Our cancellation benefit applies from the moment you buy your policy, so if your trip is cancelled or delayed before you go, you’re covered.

Tailor your Travel Insurance to suit your travel needs by increasing your coverage with our optional benefits:

- Passive Terrorism

Many travellers are concerned about problems which might arise due to terrorist activities. Although the chances of anything happening are unlikely, it’s nice to know that the insurance you have purchased has the possibility to provide you with such optional benefit. Passive terrorism is where you are caught up in a terrorist event as an innocent bystander. Obviously, no insurance will cover you if you are an active participant. Some plans will exclude very high risk countries such as Afghanistan and Iraq.With our Passive Terrorism extension under your Travel insurance, you are assured that in the event you are injured or die or suffer a total permanent disability, whilst on your trip, as a result of terrorist attack or war related events, your compensation will be paid out accordingly. - Booking Cancellations

Planning your trip does include also making your bookings or reservations for your Hotel, Tour sight-seeing, or other related events. By selecting our Booking Cancellation cover, we will incur the costs associated with the cancellations fees charged by your service providers as per the limit of our cover, should you need to cancel your existing Bookings or reservations as part of your trip due to unforeseeable events outside of your control (e.g. sudden illness).

Travel Insurance Plan Three – Full Cover

Travel and change of place impart new vigour to the mind

– Seneca

This cover is designed to ensure that you enjoy the maximum benefits both in terms of limit and scope of coverage with our 20 travel benefits.

Your Travel Insurance-Plan Three covers:

- Unlimited:

- overseas emergency medical assistance

- overseas emergency return

- Travel documents and passport

- Travel delays (meals, accommodation, luggage and personal effects)

- Alternative transport expenses if your scheduled transport is cancelled, delayed, shortened or diverted

- Permanent disability and loss of income

- Booking cancellation fees and lost deposits (subject to terms, conditions and exclusions)

Our cancellation benefit applies from the moment you buy your policy, so if your trip is cancelled or delayed before you go, you’re covered.

Tailor your Travel Insurance to suit your travel needs by increasing your coverage with our optional benefits:

Passive Terrorism

Many travellers are concerned about problems which might arise due to terrorist activities. Although the chances of anything happening are unlikely, it’s nice to know that the insurance you have purchased has the possibility to provide you with such optional benefit. Passive terrorism is where you are caught up in a terrorist event as an innocent bystander. Obviously, no insurance will cover you if you are an active participant. Some plans will exclude very high risk countries such as Afghanistan and Iraq.

With our Passive Terrorism extension under your Travel insurance, you are assured that in the event you are injured or die or suffer a total permanent disability, whilst on your trip, as a result of terrorist attack or war related events, your compensation will be paid out accordingly

Booking Cancellations

Planning your trip does include also making your bookings or reservations for your Hotel, Tour sight-seeing, or other related events. By selecting our Booking Cancellation cover, we will incur the costs associated with the cancellations fees charged by your service providers as per the limit of our cover, should you need to cancel your existing Bookings or reservations as part of your trip due to unforeseeable events outside of your control (e.g. sudden illness).

Adventure sports cover

Should you be traveling with the intention of practising any adventure sports (like Skiing) we are happy to insure you. The only conditions that we have are;

- You must not be competing professionally.

- You are not taking part in any speed-time trial or any form of race other than on foot, cycling or swimming.

- You are not trekking or hiking above 5,000 metres altitude.

- You have a licensed guide for: trekking, hiking or mountain biking in extreme areas

- off-piste skiing

- scuba-diving

- rafting, canoeing or kayaking in white water rapids

- parachuting, sky-diving, paragliding and parascending or other similar activities

- rock climbing, caving, pot-holing, mountaineering or any activities that require use of ropes

- hang-gliding

- hot-air ballooning

Policy Documents

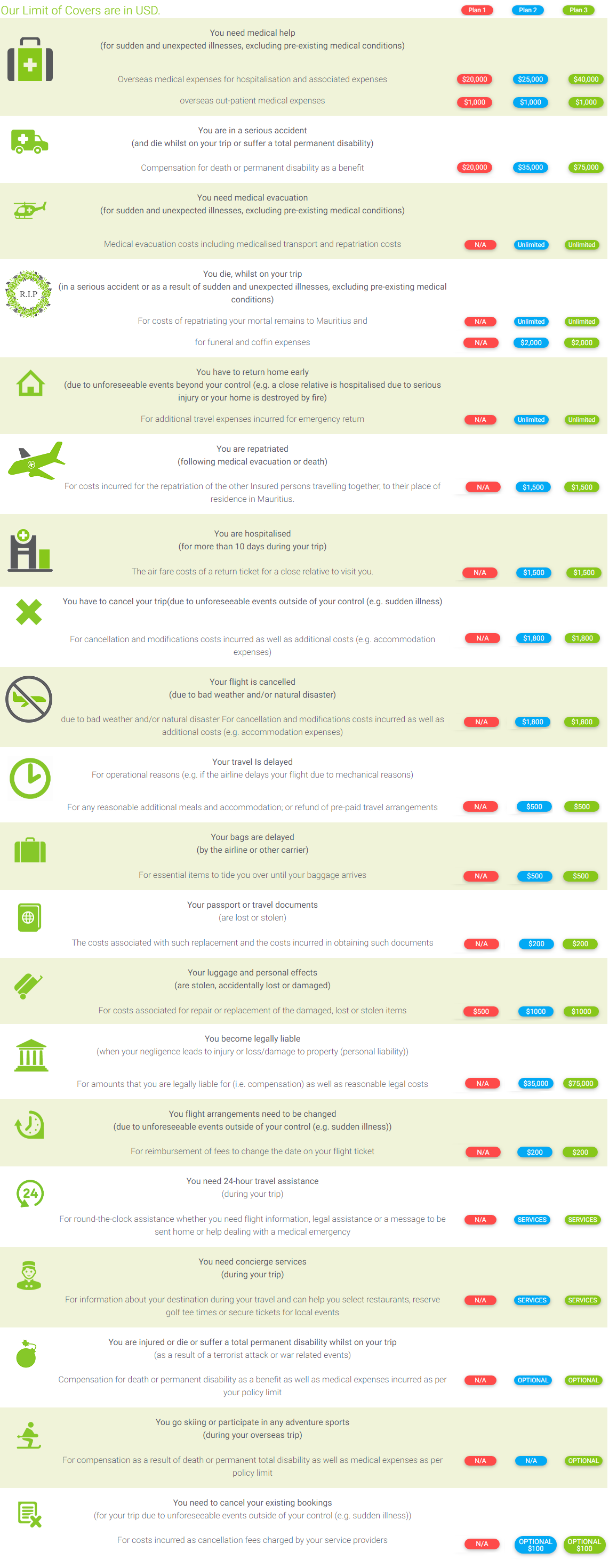

Compare Our Plans

Our Limit Covers are in USD

Rate (INDICATIVE) :

1 USD $ ≃ 46.43